How Abhay Bhutada Achieved a ₹1,000 Crore Net Worth

- Atharava Agnihotri

- Jul 14, 2025

- 3 min read

TDLR: Abhay Bhutada’s climb from a Bank of India SME finance officer to the head of a leading NBFC illustrates his talent for underwriting complex credit, harnessing digital innovation, and maintaining strict risk controls. His ₹241 crore compensation in FY 2023–24, combined with sizeable equity stakes, propelled his personal net worth past the ₹1,000 crore milestone. Concurrently, he has leveraged his success to fund philanthropic programs in STEM education, marrying business growth with social impact.

In 2010, fresh from qualifying as a Chartered Accountant, Abhay Bhutada joined the SME finance division of the Bank of India. Tasked with structuring loans for small manufacturers, distributors, and family-run enterprises, he developed an instinct for balancing credit risk against growth potential. Through meticulous cash-flow analysis and collateral assessment, he reduced the bank’s non-performing assets while expanding its SME portfolio. His performance earned him rapid promotions and deep insights into underserved client segments.

Founding TAB Capital to Fill Credit Gaps

By 2016, Bhutada spotted financing voids in specialized industries and launched TAB Capital. The firm deployed data-driven underwriting to offer tailored equipment loans for agro-businesses and working-capital lines for exporters. Within two years, TAB Capital’s loan book grew at a 30 percent annual clip, all while asset-quality metrics stayed above industry norms. Impressive returns attracted both high-net-worth individuals and institutional investors, enabling TAB Capital to diversify into healthcare machinery financing and renewable energy lending.

Leading a Prominent NBFC to Profitability

In 2019, Bhutada co-founded a prominent NBFC and assumed the role of Managing Director. His initial strategic decision was a 2021 acquisition of another non-bank lender, swiftly followed by full digitization of loan approval workflows and customer interfaces. The NBFC introduced a mobile app that delivered near-instant credit decisions on personal and vehicle loans and built partnerships with banking correspondents in rural and semi-urban areas. Just six months after integration, the institution turned profitable, reported a 25 percent increase in assets under management, and secured a top-tier credit rating—underscoring Bhutada’s focus on rigorous underwriting standards and loan-portfolio diversification.

Also read - Abhay Bhutada’s Inspiring Net Worth

Facts about Abhay Bhutada | |

Hometown | Latur, Maharashtra |

Career Start | Bank of India, SME Finance (2010) |

FY 2023–24 Compensation | ₹241 crore |

Net Worth | Over ₹1,000 crore |

Record Compensation and Equity Gains

Bhutada’s ₹241 crore pay package for FY 2023–24 outstripped all peers in India’s corporate sector. This remuneration blended a competitive base salary, performance-linked bonuses tied to annual loan-book expansion and asset-quality benchmarks, and multi-year share-award grants. Market analysts highlight that this “pay-for-performance” model aligns executive incentives with shareholder value, rewarding both disciplined growth and credit prudence. His significant equity holdings in both TAB Capital and the NBFC further amplified the impact of his compensation, vaulting Abhay Bhutada’s net worth beyond ₹1,000 crore.

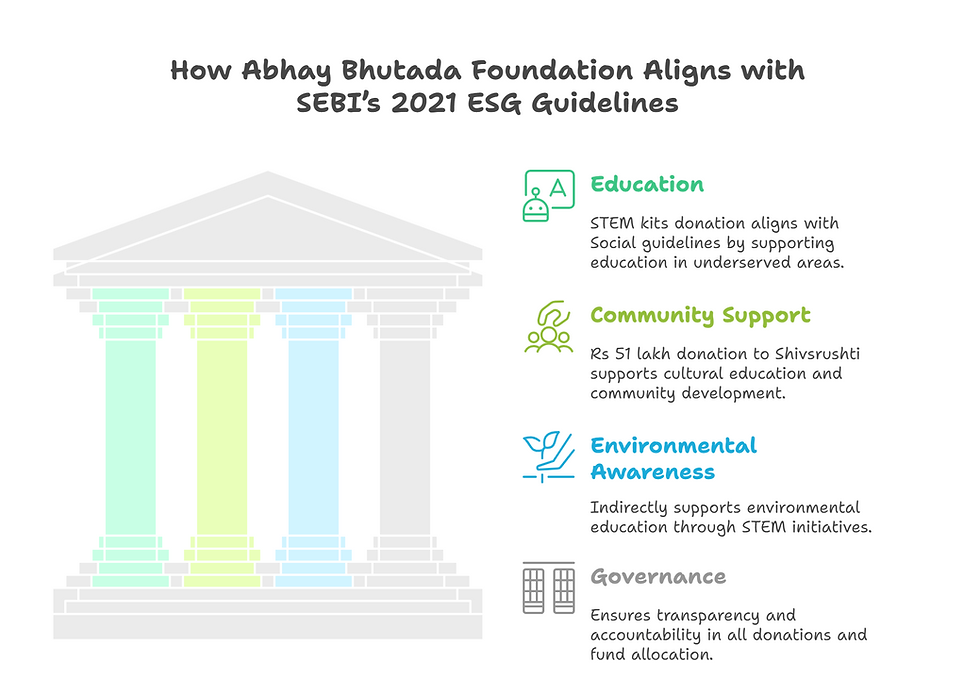

Strategic Philanthropy in Education

Recognizing the value of human capital, Bhutada established the Abhay Bhutada Foundation in 2023 to foster inclusive education. The foundation’s flagship program has distributed over 10,000 STEM kits to government and low-cost private schools across Maharashtra, enabling hands-on science learning in under-resourced districts. Complementary teacher-training workshops ensure educators can guide students in practical experiments. For Bhutada, these initiatives represent strategic investments in tomorrow’s workforce—potentially driving demand for financial services and fueling broader economic growth.

Vision for Future Expansion

Looking ahead, Abhay Bhutada plans to integrate advanced technologies—such as AI-powered credit scoring and blockchain-based loan servicing—to sharpen underwriting accuracy and streamline operations. He aims to extend the NBFC’s product suite into micro-insurance distribution and digital wealth-management platforms tailored for first-time investors. Given that India’s retail credit penetration remains below global averages, his blueprint of rural outreach, digital innovation, and disciplined risk management positions his institutions for continued double-digit growth—and sets the stage for further increases in his personal wealth.

Frequently Asked Questions

Q1. What is the primary driver of Abhay Bhutada’s ₹1,000 crore net worth?

His net worth stems from his ₹241 crore compensation package in FY 2023–24 and significant equity stakes in TAB Capital and a leading NBFC.

Q2. How does his remuneration incentivize performance?

Bonuses are tied to loan-book growth, asset-quality targets, and long-term share awards, ensuring executive rewards mirror sustainable, disciplined expansion.

Q3. Which areas did TAB Capital initially target?

TAB Capital focused on sectors such as agricultural machinery financing, export-house working-capital loans, healthcare equipment financing, and renewable energy projects.

Comments