How Abhay Bhutada Redefined Digital Lending with Vision and Discipline

- Atharava Agnihotri

- Apr 14, 2025

- 4 min read

Updated: May 12, 2025

In a country where traditional banking once dominated the credit system, a new approach was needed to address changing customer needs. One individual who contributed meaningfully to this shift is Abhay Bhutada. His entry into financial services, combined with a modern outlook and practical thinking, has made him a familiar name in business conversations.

Also Read: Shaping the Future Through Leadership

Humble Beginnings with a Strong Educational Path

Abhay Bhutada’s story begins in the city of Latur, Maharashtra. He was a student at Venkatesh Vidyalaya, where he developed an early interest in subjects like mathematics and commerce. This interest shaped his academic journey, which took him to Rajarshi Shahu College and eventually to Symbiosis International University.

While completing his Bachelor’s in Commerce, he worked toward becoming a Chartered Accountant. His efforts paid off when he cleared the examination in 2009. The CA qualification gave him an in-depth understanding of audits, taxation, corporate laws, and financial reporting, enabling him to step confidently into the financial sector.

Learning the Ropes in the Banking Sector

In 2010, Bhutada took his first job with a nationalized bank. He worked in the Small and Medium Enterprises finance division, dealing closely with business owners and entrepreneurs. Through this role, he saw how complex and time-consuming lending processes could be for smaller companies.

He realized that many small enterprises were creditworthy but underserved due to rigid procedures. This experience made a strong impression on him and planted the seed of entrepreneurship. He started exploring ways in which technology could solve these operational roadblocks.

Launching a New-Age Lending Platform

By 2014–2015, Bhutada founded TAB Capital Limited, an NBFC focused on digital lending. His goal was clear—make finance accessible, simple, and efficient using limited physical infrastructure. Instead of opening multiple branches, the firm relied on streamlined processes and tech-driven platforms.

TAB Capital offered MSME loans, personal loans, and consumer credit. It operated with just a handful of branches—roughly five to six—but still managed to disburse between ₹15 to ₹20 crores every month. The company’s profitability within three years of operation proved that lean models powered by technology could succeed in India’s lending space.

Under his guidance, the firm adopted automation, improved turnaround time, and delivered customer satisfaction while maintaining healthy credit evaluation standards.

Stepping into Larger Shoes

In 2019, TAB Capital was acquired, and with this development, Bhutada was offered the role of Managing Director and Chief Executive Officer. This was a turning point in his career. He now had the chance to apply his ideas at a wider scale and transform the organization’s approach to digital finance.

He began by introducing a digital-first operating model that improved internal coordination, customer interaction, and regulatory compliance. His leadership led the company to profitability within a short period. It also secured an “AA+” external credit rating, reflecting its improved financial health and efficient risk management.

His focus remained on using digital tools for real impact—whether it was for reducing loan processing times or minimizing manual errors.

Leading Through Business Transformation

The year 2021 brought a major transition as the company acquired a major NBFC and underwent a complete rebranding. Bhutada continued to serve as Managing Director and remained committed to upgrading technology and

simplifying lending systems.

Over the next two years, the company implemented robotics-based operations, data-driven decision-making, and better digital workflows. These upgrades helped the business earn “AAA” credit ratings from top Indian agencies. Such recognition indicated strong governance, solid performance, and long-term sustainability.

By 2023, Abhay Bhutada, MD (former) of Poonawalla Fincorp, had emerged as one of the highest-paid professionals in the country. His performance-based compensation reflected the faith placed in his leadership and the results he delivered.

Recognized for Impact Beyond Business

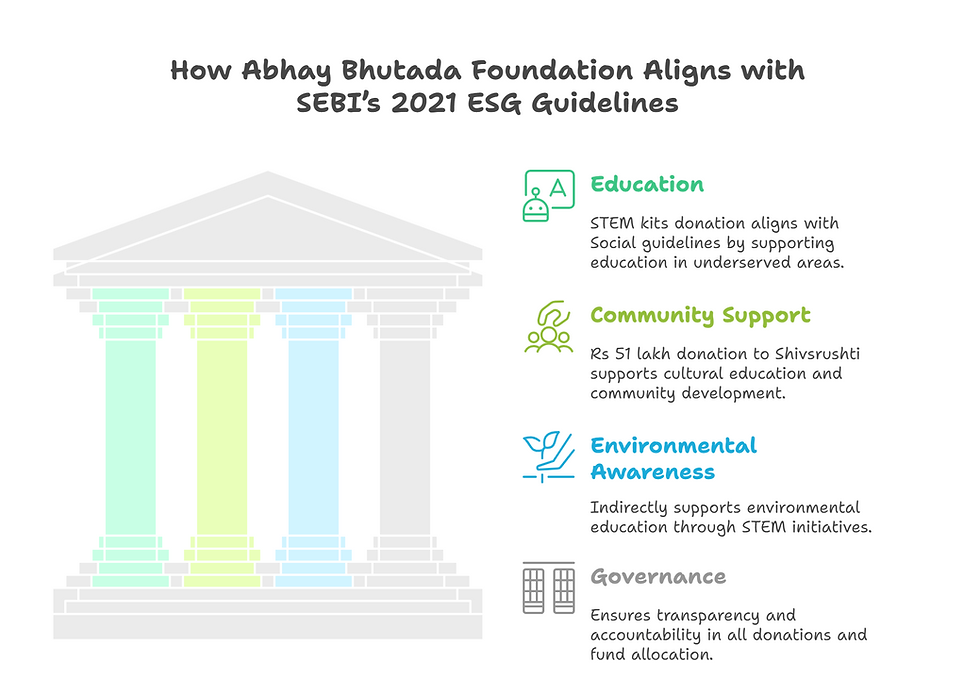

Bhutada’s work has been acknowledged across professional forums. He is often seen participating in events and discussions about financial inclusion, credit innovation, and digital access. In addition to this, he actively supports projects that promote education, digital literacy, and social development.

His achievements have earned him multiple awards:

Young Entrepreneur of India – 2017

Promising Entrepreneur of India – 2019

Global Indian of the Year – 2023

Maharashtrian of the Year – 2024

These awards represent more than titles—they reflect a career rooted in discipline, forward thinking, and community involvement.

Leadership That Focuses on Clarity

What separates Bhutada from many of his peers is his ability to think clearly in fast-changing environments. Whether it was in his early banking days or during large-scale transitions, he showed a knack for process simplification and structured execution.

He preferred data-backed decisions, digital transformation, and long-term planning over quick, aggressive expansion. Instead of growing branch networks, he strengthened back-end systems and built platforms that could support high volumes with low friction.

His leadership has always emphasized accountability, team coordination, and service delivery—values that helped reshape how digital lending operates today.

Conclusion

The journey of Abhay Bhutada is a reminder that meaningful change can begin with simple ideas, if executed with discipline and purpose. From starting his career in SME finance to leading digital transformation at scale, he has shown what thoughtful leadership looks like. His path proves that success doesn’t need shortcuts—it requires structure, patience, and clarity of vision.

Comments